Business

Could You Be Paying Too Much? How to Cut Costs by Reevaluating Your Insurance

Insurance is one of those expenses most people set up once and then mentally file away for years. Sound familiar? This “set it and forget it” mindset might be convenient, but it could be draining hundreds, maybe even thousands, of dollars from your bank account every year. The insurance landscape shifts constantly, with fresh companies jumping into the market, established providers tweaking their rates, and your own life circumstances evolving in ways that directly impact what you pay. Taking the time to re-evaluate your coverage isn’t just savvy money management; it’s essential if you want to stop overpaying.

Understanding Why Insurance Costs Increase Over Time

Ever notice how your insurance bill seems to creep upward year after year, even when nothing’s changed? There’s actually a method behind this frustrating pattern. Insurers constantly recalibrate their pricing models using actuarial data, regional claims patterns, and broader economic shifts like inflation and skyrocketing repair costs. But here’s what really matters: your personal risk profile changes too. Maybe you’ve relocated to a different neighborhood, switched careers, seen your credit score bounce around, or simply celebrated another birthday, all these factors can nudge your rates higher.

Conducting a Comprehensive Coverage Audit

Before you can trim your insurance spending, you’ve got to know exactly what you’re paying for and whether it still makes sense for your situation. Pull together all your policies, auto, home, life, health, and any specialized coverage, and build a detailed spreadsheet that captures coverage amounts, deductibles, monthly or annual premiums, and any extras you’ve added along the way. You might be surprised by what you discovered. Plenty of folks are still paying for collision coverage on a car that’s barely worth a couple thousand dollars, or rental car coverage when they’ve got two other vehicles sitting in the driveway.

Shopping the Market for Competitive Rates

Once you’ve got a clear picture of your current coverage, it’s time to hit the marketplace and see what else is out there. The insurance world has become remarkably competitive lately, with traditional brick-and-mortar companies now battling against direct-to-consumer online insurers and those innovative usage-based models that use telematics to customize your rates. Don’t settle for just a couple of quotes, reach out to at least five to seven different providers, making absolutely sure you’re comparing apples to apples in terms of coverage limits, deductibles, and policy features. Working with an independent insurance agent can be a game-changer here, since they can shop for multiple carriers simultaneously and sometimes uncover deals, you’d never find on your own. When you’re comparing options for car insurance in California , look beyond just that bottom, line premium number. Some insurers throw in valuable perks like accident forgiveness, shrinking deductibles over time, or genuinely helpful customer service that adds real value beyond the sticker price. And don’t automatically dismiss smaller regional players; these companies often operate with lower overhead than the big national brands and can offer seriously competitive rates in your specific area. Remember, the cheapest doesn’t automatically mean the best. You’ll want to balance potential savings against the company’s financial strength, their reputation for actually paying claims, and how they treat customers when things go wrong. This methodical shopping approach almost always uncovers significant savings that have emerged since you last bothered to compare.

Maximizing Available Discounts and Policy Adjustments

Insurance companies dangle literally dozens of potential discounts that most policyholders never even know about, much less claim. Why? Usually because nobody asks. Common money, savers include bundling multiple policies together, maintaining a squeaky-clean claims record, knocking out a defensive driving course, installing a home security system, belonging to certain professional organizations, demonstrating safe driving habits, or even just going paperless and setting up automatic payments. Life changes can unlock fresh discount opportunities too. Getting married, paying off your mortgage, or retiring might each qualify you for reduced rates.

Negotiating with Your Current Provider

Before you jump ship to a new insurer, give your current company a fair shot at keeping your business by matching or beating what competitors are offering. Most insurance companies maintain dedicated retention departments specifically tasked with preventing customer defections, and these folks typically have authority to extend discounts and adjustments that regular customer service reps simply can’t. Call your insurer armed with concrete competing quotes, and explain that while you’ve been a loyal customer, you’ve found significantly better rates elsewhere. Be ready to highlight any positive changes in your risk profile, improved credit, reduced annual mileage, or a spotless driving record all strengthen your negotiating position.

Timing Your Insurance Policy Changes Strategically

When you’ve decided to make coverage changes, timing those moves strategically can maximize savings and minimize headaches. Most policies have specific renewal dates, and making changes right at renewal typically helps you avoid cancellation fees or messy pro-rated premium adjustments that can devour your hard-won savings. However, if you’re staring down a massive rate increase at renewal, it might still be worth crunching the numbers on a mid-term switch despite potential fees. If you’re bundling multiple policies with a new insurer, coordinate everything carefully so all transitions happen simultaneously, that way you capture those multi-policy discounts immediately.

Conclusion

Re-evaluating your insurance coverage ranks among the most straightforward ways to slash monthly expenses without compromising your lifestyle or financial security. By understanding what drives cost increases, conducting thorough coverage audits, actively shopping the competitive marketplace, maximizing every available discount, negotiating assertively with your current provider, and timing changes strategically, you could potentially pocket hundreds or even thousands of dollars annually. The real key is transforming insurance review from a one-time hassle into regular practice. Committing to annual evaluations ensures you continuously capture the best available rates as both your circumstances and the insurance market evolve. Don’t let simple inertia drain your wallet.

-

Celebrity9 months ago

Celebrity9 months agoNick Schmit? The Man Behind Jonathan Capehart Success

-

Celebrity9 months ago

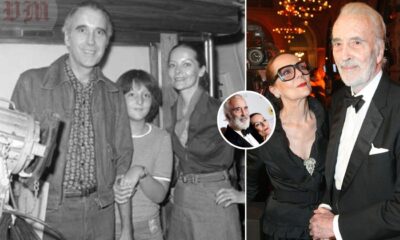

Celebrity9 months agoChristina Erika Carandini Lee: A Life of Grace, Heritage, and Privacy

-

Celebrity9 months ago

Celebrity9 months agoTrey Kulley Majors: The Untold Story of Lee Majors’ Son

-

Celebrity10 months ago

Celebrity10 months agoJamie White-Welling: Bio, Career, and Hollywood Connection Life with Tom Welling