Crypto

Trade 1000 Urex – Expert Tips to Avoid Common Mistakes

Trade 1000 Urex is rapidly emerging as a noteworthy term in online trading communities, especially among retail investors and algorithmic traders. While it’s still relatively new in the broader trading lexicon, Trade 1000 Urex has gained attention due to its association with innovative trading tools and strategic platforms designed for both novice and experienced traders. Whether you’re exploring it as a trading platform, an algorithmic model, or an advanced trading toolset, understanding how to use Trade 1000 Urex effectively is crucial. In this article, we’ll explore what it is, how it works, and most importantly—expert tips to avoid common pitfalls.

What is Trade 1000 Urex?

Trade 1000 Urex is not a conventional trading platform or asset. Instead, it refers to a new generation trading protocol or system that integrates artificial intelligence (AI), quantitative analysis, and machine learning to enhance decision-making in trading environments. Developed with real-time data processing capabilities, Trade 1000 Urex is tailored to help traders execute faster, more accurate trades, reducing human error and emotional bias.

This protocol is believed to have been introduced in late 2024 through a consortium of fintech companies seeking to revolutionize the trading ecosystem. It offers integration with existing platforms like MetaTrader, Thinkorswim, and TradingView, while also supporting automated bot functions and complex technical indicators.

How Trade 1000 Urex Works in Real-Time Trading

Trade 1000 Urex operates by collecting vast amounts of market data in real-time and analyzing it through advanced algorithms. These algorithms detect trading signals, market trends, support/resistance zones, and volatility indicators. Using this insight, the system can provide entry and exit recommendations, or automatically execute trades based on pre-set user parameters.

One key feature is its ability to adapt through machine learning. As the user continues to trade, the system adjusts and evolves based on past performance, personal risk profile, and market behavior. This continuous learning cycle makes Trade 1000 Urex a powerful tool for personalized trading strategies.

Benefits of Using Trade 1000 Urex

Adopting Trade 1000 Urex in your trading toolkit offers several advantages:

-

Increased Accuracy – AI-powered analytics reduce false signals.

-

Faster Execution – Automated trades are executed in milliseconds.

-

Risk Management Tools – Integrated stop-loss, trailing stops, and margin alerts.

-

Customization – Supports personalized indicators and trade preferences.

-

Cross-Platform Support – Compatible with mobile and desktop trading platforms.

These benefits make it especially useful for day traders, swing traders, and algorithmic investors looking for a competitive edge.

Common Mistakes to Avoid When Using Trade 1000 Urex

While Trade 1000 Urex offers advanced features, it’s not foolproof. Misuse or over-reliance can result in costly errors. Here are some expert tips to avoid the most frequent mistakes:

-

Over-automation – Allowing the tool to trade entirely on autopilot without regular oversight can lead to unchecked losses.

-

Ignoring Market News – AI tools can’t always react to unexpected geopolitical events or economic announcements.

-

Lack of Backtesting – Not testing the tool’s strategy with historical data can result in poor live performance.

-

Neglecting Risk Management – Failing to set proper stop-loss levels may negate the benefits of AI-enhanced trading.

-

Overconfidence in AI – Believing the system is infallible often results in high-risk trades.

Trade 1000 Urex vs. Traditional Trading Methods

Unlike traditional trading, which depends heavily on human interpretation of charts and market sentiment, Trade 1000 Urex brings automation, predictive analytics, and emotionless execution into the mix. Here’s a quick comparison:

| Feature | Traditional Trading | Trade 1000 Urex |

|---|---|---|

| Speed | Slower (manual) | Milliseconds |

| Decision Making | Emotion-based | Data-driven |

| Strategy | Static | Adaptive |

| Risk Management | Manual | Automated Alerts |

| Learning Curve | Steep | Moderate with support tools |

The use of Trade 1000 Urex can significantly reduce the time required to learn and execute trades effectively.

The Role of AI and Machine Learning in Trade 1000 Urex

At its core, Trade 1000 Urex harnesses the power of AI and machine learning. These technologies allow it to analyze historical patterns, recognize candlestick formations, predict volatility, and even assess macroeconomic indicators through natural language processing (NLP).

The machine learning algorithms constantly refine their predictive capabilities. For example, if a user consistently sees poor results from trades based on RSI divergence, the system can adjust the weighting of this indicator in future trades.

Importance of Customizing Trade 1000 Urex Settings

No two traders are alike. Therefore, using Trade 1000 Urex “out of the box” without any customization may not yield optimal results. Expert users recommend customizing:

-

Risk-reward ratios

-

Position sizing rules

-

Preferred indicators (e.g., Fibonacci, Bollinger Bands)

-

Market type preferences (e.g., Forex, Crypto, Stocks)

-

Timeframes (scalping vs. swing trading)

Setting personalized parameters ensures that Trade 1000 Urex aligns with your financial goals and risk tolerance.

How One Trader Improved ROI with Trade 1000 Urex

Take the example of an intermediate trader who had been struggling with emotional decision-making in high-volatility markets. After implementing Trade 1000 Urex and setting specific entry/exit rules based on Bollinger Bands and MACD crossovers, the trader saw a 23% increase in ROI over three months.

What made the difference? Discipline enforced by automation, reduced overtrading, and clearer signals filtered by the system’s AI.

Advanced Strategies with Trade 1000 Urex

Seasoned users have found several ways to enhance their strategies using Trade 1000 Urex, such as:

-

Hedging multiple positions across correlated assets

-

Scalping in high-frequency markets using ultra-fast execution

-

Building hybrid strategies, combining discretionary and automated methods

-

Integrating sentiment analysis, using Urex’s API with third-party data feeds like Twitter or Bloomberg

These advanced methods allow users to capitalize on both macro and micro opportunities.

Is Trade 1000 Urex Suitable for Beginners?

Yes, but with caution. Trade 1000 Urex offers a user-friendly interface, guided tutorials, and demo trading options. However, beginners must spend adequate time understanding market basics and system functionalities before going live.

A common mistake is diving into live markets without testing or understanding risk parameters. Starting with a demo account and transitioning slowly is strongly recommended.

Regulatory Considerations and Security

Trade 1000 Urex aligns with financial trading standards and regulatory expectations. While not a broker itself, it connects with regulated platforms. Data encryption, multi-factor authentication, and end-to-end trade logging help ensure user security.

Still, users must ensure that their brokers are compliant with local regulations and that API access through Urex doesn’t violate any trading terms.

Future of Trade 1000 Urex – What’s Next?

Experts predict that Trade 1000 Urex will evolve into a multi-layered ecosystem incorporating decentralized finance (DeFi) elements and blockchain-based authentication. There are also talks of integrating social trading features, where users can follow, mimic, or challenge trading strategies from others in the community.

Another exciting development is the potential for AI-powered voice command trading and multi-language support, making it globally accessible.

Final Thoughts

Trade 1000 Urex is a breakthrough in modern trading. Its AI-driven approach, adaptability, and powerful automation tools make it a game-changer for many traders. However, like any tool, its effectiveness depends on how it’s used. By understanding its features, customizing it to your needs, and avoiding common mistakes, you can harness its full potential and improve your trading outcomes.

Whether you’re a beginner or a seasoned trader, integrating Trade 1000 Urex into your strategy could mark a turning point in your trading journey.

FAQs About Trade 1000 Urex

1. What exactly does Trade 1000 Urex do?

Trade 1000 Urex is an advanced trading system that uses artificial intelligence and machine learning to analyze real-time market data, provide actionable signals, and even automate trades. It adapts to your trading behavior and evolves over time to improve decision-making. The system doesn’t replace human intuition but enhances it with data-backed insights. It can integrate with various platforms and helps reduce emotional trading by offering strict rules and automated responses.

2. Is Trade 1000 Urex safe to use for real-money trading?

Yes, Trade 1000 Urex is designed with robust safety features like end-to-end encryption, secure API integrations, and user-level access controls. However, safety also depends on the broker or exchange you connect it with. Always ensure you’re using a licensed, regulated broker. Additionally, use two-factor authentication and avoid granting full auto-trading permissions until you’re confident in the system’s performance on a demo account.

3. Can beginners use Trade 1000 Urex effectively?

Beginners can absolutely benefit from Trade 1000 Urex, especially because it simplifies technical analysis and trade execution. However, there’s a learning curve. New users should start with the demo account, study the tutorials, and gradually implement live trading with small amounts. Without understanding the basic mechanics of the market, even the best AI tool won’t prevent losses.

4. How does Trade 1000 Urex compare to other trading bots?

Trade 1000 Urex is more than just a trading bot—it’s a dynamic trading system that learns and adapts. Most bots operate on fixed logic, executing trades based on simple rules. In contrast, Urex employs machine learning to update its strategies based on performance data, market shifts, and user preferences. This makes it more reliable in volatile and unpredictable market conditions.

5. What are the biggest risks of using Trade 1000 Urex?

The main risks stem from misuse or misunderstanding. Over-reliance on automation without proper risk management settings can lead to large losses. Another risk is assuming the system is infallible—markets can shift due to unforeseen global events that AI may not instantly account for. Lastly, integrating with unregulated brokers or giving full permissions without safeguards can expose you to fraud or system errors.

-

Celebrity8 months ago

Celebrity8 months agoNick Schmit? The Man Behind Jonathan Capehart Success

-

Celebrity9 months ago

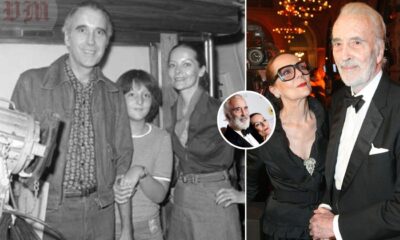

Celebrity9 months agoChristina Erika Carandini Lee: A Life of Grace, Heritage, and Privacy

-

Celebrity9 months ago

Celebrity9 months agoTrey Kulley Majors: The Untold Story of Lee Majors’ Son

-

Celebrity9 months ago

Celebrity9 months agoJamie White-Welling: Bio, Career, and Hollywood Connection Life with Tom Welling