Business

Steps You Can Take If You Are Financially Stressed

Money worries can mess with your head and body affecting your sleep and how you get along with family and friends. You’re not alone in feeling this way. The good thing is you can take real steps to tackle money stress head-on and work to build lasting financial stability.

Check Out Your Money Situation Now

Taking control of your money begins with a close examination of your current financial situation. Start collecting those important money documents. Put all this info into a detailed spreadsheet that shows where your money comes from and where it goes each month. Here’s a cool fact: people who keep an eye on their finances are 43% more likely to achieve their money targets and feel less worried about their financial situation.

Make a Budget You Can Stick To

A good budget isn’t just about cutting costs; it’s your map to money success. Consider using the 50/30/20 rule: spend 50% of your money on needs, 30% on wants, and 20% on savings and debt payoff. You can use a budget app or old-school spreadsheets to keep tabs on your spending; it helps. In fact, people who budget tend to save 18% more cash each year than those who don’t plan ahead. Money pros suggest taking a step-by-step approach to get the best results.

Look for Ways to Earn More

Making money from different sources can ease the strain on your wallet. You’ve got lots of choices: freelancing, working part-time, or even looking into prop firms if trading catches your eye. The gig economy has seen a big jump of 33%, and now that remote work is more widespread, you can find many flexible ways to earn extra cash. Knowing the basic ideas helps people steer clear of common errors and traps.

Negotiate Bills and Expenses

You’d be amazed at how many of your regular bills you can haggle over. Don’t hesitate to call your service providers and ask for better rates on utilities, insurance, or phone plans. Here’s a fun fact: 80% of folks who try to negotiate their bills end up paying less. Think about downgrading services bundling packages, or switching providers to snag better deals. Lots of people have had luck by tweaking these tricks to fit their own situations.

Get Help from a Money Expert

A financial advisor can be as valuable as gold when it comes to handling money worries. They’ll help you make solid plans to pay off debt, show you smart ways to invest, and teach you how to save on taxes. The numbers tell the story; folks who work with financial advisors save almost four times more for retirement than those who don’t. The secret is to stick with it and pay close attention to every detail along the way.

Put Debt Management Plans into Action

Getting a handle on debt needs a step-by-step plan. You can pick the debt snowball method (paying off small debts first) or the avalanche way (targeting high-interest debts). Having a strategy has a big effect. Talk to your lenders about lower interest rates or different payment plans.

Create a Rainy-Day Fund

Picture a rainy-day fund as your money safety cushion. Begin with small amounts; even $25 or $50 weekly adds up. Try to save enough to cover 3-6 months of expenses. Here’s a striking fact: having a rainy-day fund cuts down on money stress by 68% and gives key protection when surprise costs come up.

Focus on Mental Health

Taking care of your mental health is just as crucial as crunching numbers when you’re dealing with money worries. Try to cut down on stress by meditating, working out, or chatting with a therapist.

Conclusion

To beat financial stress, you need to balance smart money moves with looking after your emotions. These steps might seem like a lot at first, but keep in mind that every little thing you do helps build a stronger financial foundation and gives you peace of mind. Keep your eyes on what you want to achieve, but don’t be too hard on yourself. Making real improvements with your money takes time, and small steady steps can lead to amazing results down the road.

-

Celebrity8 months ago

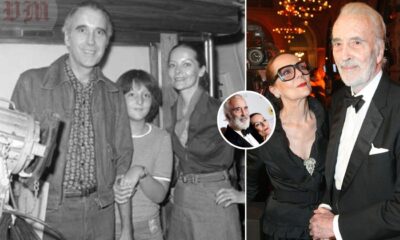

Celebrity8 months agoChristina Erika Carandini Lee: A Life of Grace, Heritage, and Privacy

-

Celebrity8 months ago

Celebrity8 months agoTrey Kulley Majors: The Untold Story of Lee Majors’ Son

-

Celebrity7 months ago

Celebrity7 months agoNick Schmit? The Man Behind Jonathan Capehart Success

-

Celebrity8 months ago

Celebrity8 months agoJamie White-Welling: Bio, Career, and Hollywood Connection Life with Tom Welling