Business

Top Auto Insurance Myths Drivers Still Believe

Auto insurance ranks among those necessary expenses that most drivers don’t fully grasp, which leads to widespread misconceptions that can drain your wallet or leave you dangerously under protected. Despite carrying coverage for years, many motorists operate under false assumptions about how their policies actually work, what factors drive their rates up or down, and what protections they genuinely have when trouble strikes. These myths persist through generations, passed along as “common knowledge” without anyone bothering to question their validity. Getting to the truth behind these misconceptions can help you make smarter decisions about your coverage, potentially save hundreds of dollars each year, and ensure you’ve got the protection you need when accidents inevitably happen.

Red Cars Cost More to Insure

One of the most stubborn myths in auto insurance? The belief that red vehicles carry heftier premiums than cars of other colors. This misconception has hung around for decades, probably stemming from the association between red cars and sports vehicles, or the perception that red car owners drive more aggressively. Here’s the reality: insurance companies don’t even ask about your vehicle’s color when calculating your rates, and color doesn’t appear anywhere in the underwriting algorithms that determine what you’ll pay. What actually matters? Your car’s make, model, year, engine size, safety features, repair costs, and theft rates for that particular vehicle.

Your Credit Score Doesn’t Affect Insurance Rates

Many drivers are genuinely surprised to discover that their credit history plays a significant role in determining auto insurance premiums in most states. Insurance companies use credit-based insurance scores, which analyze your credit behavior patterns to predict the likelihood of filing claims. Studies have consistently shown statistical correlations between credit management and claims frequency, leading insurers to incorporate this factor into their risk assessment models, whether that seems fair or not. Drivers with poor credit can pay significantly more for the same coverage compared to those with excellent credit, sometimes hundreds or even thousands of dollars more annually. Now, this practice isn’t allowed everywhere, California, Hawaii, Massachusetts, and Michigan have banned or limited the use of credit scores in insurance underwriting, but it remains standard practice in most of the country. When comparing coverage options in states where credit scoring is restricted, professionals who need to evaluate policy costs rely on affordable car insurance in California providers that focus on other risk factors like driving history and vehicle type. Improving your credit score by paying bills on time, reducing debt, and correcting errors on your credit report can lead to meaningful savings on your insurance premiums. This connection underscores the importance of maintaining good credit not just for loans and credit cards, but for the broader financial impact it has throughout your life.

Comprehensive Coverage Means You’re Covered for Everything

The term “comprehensive coverage” sounds wonderfully all-encompassing, which leads many drivers to believe this coverage protects them against any possible damage to their vehicle. In reality, comprehensive coverage has a specific definition that covers non-collision incidents, things like theft, vandalism, fire, hail, flood, animal strikes, and falling objects. It doesn’t cover collision damage, mechanical breakdowns, normal wear and tear, or damage from potholes, which fall under different coverage types or aren’t covered at all. To be fully protected from collision accidents, you need separate collision coverage, which pays for damage when you hit another vehicle or object regardless of who’s at fault.

Your Insurance Follows Your Car, Not You

There’s a common misconception that auto insurance is tied exclusively to the vehicle rather than the policyholder, which leads to confusion about coverage when lending your car to others or driving someone else’s vehicle. The reality? It’s actually more nuanced than that. Your insurance primarily follows your car, meaning if you lend your vehicle to a friend and they cause an accident, your insurance will typically be the primary coverage that responds to the claim. However, you as the policyholder are also covered when driving other vehicles in many situations, providing secondary coverage that kicks in if the car owner’s insurance is insufficient.

Minimum Coverage Is Sufficient Protection

State-mandated minimum insurance requirements exist to ensure basic financial responsibility, but they’re rarely adequate to protect drivers from the true costs of serious accidents. Most states require liability coverage somewhere in the range of twenty-five to fifty thousand dollars per person for bodily injury, which sounds substantial until you consider that medical bills from severe injuries routinely exceed one hundred thousand dollars or more. If you cause an accident that results in injuries exceeding your coverage limits, you become personally liable for the difference, potentially leading to wage garnishment, property liens, or even bankruptcy. Minimum coverage typically doesn’t include comprehensive or collision protection for your own vehicle, meaning you’d receive nothing to repair or replace your car regardless of who caused the accident.

Older Cars Don’t Need Full Coverage

Many drivers believe that once their vehicle reaches a certain age or drops below a specific value, they should drop comprehensive and collision coverage to save money on premiums. While this logic has some merit, it oversimplifies the decision and doesn’t account for individual circumstances that might make keeping full coverage worthwhile. The general rule of thumb suggests dropping these coverages when your annual premium for comprehensive and collision exceeds ten percent of your car’s value, but this ignores your financial situation and ability to replace the vehicle out of pocket. If you couldn’t afford to replace your older car if it were totaled or stolen, maintaining comprehensive and collision coverage might make sense even if the vehicle isn’t worth much by market standards, because what matters is your ability to absorb the loss, not just the car’s book value.

Conclusion

Dispelling these common auto insurance myths empowers you to make informed decisions about your coverage and avoid costly mistakes based on misinformation that’s been circulating for years. Understanding that factors like credit scores and coverage limits matter far more than vehicle color or age helps you focus on what actually impacts your rates and protection levels. The insurance industry can seem complex and deliberately opaque, but taking time to learn how policies actually work, what coverage truly means, and which factors influence your premiums puts you back in control of your insurance decisions. Don’t rely on assumptions or secondhand information when it comes to protecting yourself financially on the road, read your policy documents thoroughly, ask questions until you genuinely understand the answers, and regularly review your coverage to ensure it still meets your evolving needs.

-

Celebrity8 months ago

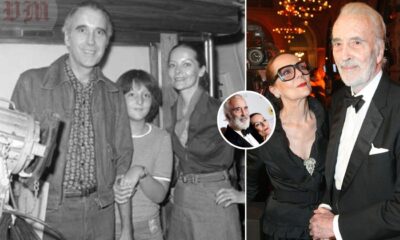

Celebrity8 months agoChristina Erika Carandini Lee: A Life of Grace, Heritage, and Privacy

-

Celebrity8 months ago

Celebrity8 months agoNick Schmit? The Man Behind Jonathan Capehart Success

-

Celebrity8 months ago

Celebrity8 months agoTrey Kulley Majors: The Untold Story of Lee Majors’ Son

-

Celebrity9 months ago

Celebrity9 months agoJamie White-Welling: Bio, Career, and Hollywood Connection Life with Tom Welling