Business

5 Common Retirement Planning Mistakes and How to Avoid Them

Retirement planning ranks among the most important financial moves you’ll make during your working life, yet it’s surprisingly easy to stumble into traps that can seriously undermine your golden years. Whether you’re fresh out of college or counting down the years to retirement, getting a handle on these common missteps can make all the difference in building a solid financial foundation. The good news? Recognizing these pitfalls early gives you the power to course-correct and set yourself up for the comfortable retirement you’ve been dreaming about. What separates a retirement filled with peace of mind from one plagued by financial anxiety often boils down to staying informed, maintaining discipline, and making smart choices throughout your career.

Starting Too Late and Underestimating Time Value

Here’s a mistake that costs people dearly: putting off retirement savings while thinking you’ll catch up later. The truth is, compound interest works like magic when you give it enough runway, and starting in your twenties or early thirties means even small contributions can mushroom into substantial nest eggs over the decades. It’s tempting to push retirement planning to the back burner when you’re juggling student loans, saving for a house, or covering childcare expenses, but that delay comes with a steep price tag. The numbers don’t lie: if you start socking money away at 25, you’ll need to contribute far less each month than someone who waits until 45 to reach the same finish line.

Failing to Maximize Employer Retirement Benefits

You’d be surprised how many people essentially turn down free money by not fully tapping into their employer’s retirement perks, especially those sweet 401(k) matching contributions. When your company offers to match your contributions, that’s literally bonus cash that turbocharges your retirement savings, yet research shows about a third of workers don’t contribute enough to snag the full match. But the missed opportunities don’t stop there. Plenty of employees overlook other valuable goodies like profit-sharing arrangements, employee stock purchase plans, or health savings accounts that can beef up your retirement income down the road.

Underestimating Healthcare Costs and Longevity

One of the biggest blind spots in retirement planning? Drastically underestimating what healthcare will cost and how long your savings need to stretch. Medical expenses represent one of the heftiest, and fastest-rising, costs retirees grapple with, and experts estimate a 65-year-old couple hanging up their work boots today might need somewhere between $300, 000 and $400, 000 just for healthcare throughout retirement. Here’s where many folks get tripped up: they assume Medicare handles everything, but that government safety net has gaps, deductibles, and coverage limits that mean you’ll need supplemental insurance or be ready to pay out of pocket. Don’t even get started on long-term care costs, which Medicare typically won’t touch and can absolutely demolish your retirement savings if you haven’t planned ahead.

Ignoring Tax Diversification Strategies

Tax planning often gets pushed to the sidelines during retirement prep, with many people piling everything into tax-deferred accounts without thinking through what happens when they start making withdrawals down the road. Sure, traditional 401(k)s and IRAs give you that nice immediate tax break, but remember, every single dollar you pull out in retirement gets taxed as ordinary income, which could bump you into a higher tax bracket than you expected. This approach creates a real headache when required minimum distributions kick in at seventy-three, potentially leaving you with some unpleasant tax surprises.

When navigating these complex tax considerations, professionals who need to optimize their retirement income strategy often work with retirement planning in Howard County, MD to incorporate tax diversification across traditional tax-deferred accounts, Roth accounts where withdrawals are tax-free, and taxable investment accounts that offer more flexible withdrawal options. Having different buckets of money with varying tax treatments gives you the flexibility to strategically manage your tax bill each year based on what makes sense for your situation. Plus, this approach serves as a hedge against future tax rate uncertainty, and let’s face it, many experts think rates are heading up, not down. Overlooking the tax consequences of your retirement income can seriously dent your spending power and box you into a corner when you should be enjoying your hard-earned freedom.

Lacking a Comprehensive Income Strategy

Perhaps the biggest oversight? Focusing all your energy on building that nest egg without mapping out how you’ll actually convert those assets into reliable income that lasts as long as you do. Most people obsess over the accumulation phase, watching their account balances grow, but give surprisingly little thought to the drawdown phase where the rubber really meets the road. This gap in planning can lead to withdrawing too aggressively early on and risking running out of money, or being so cautious that you unnecessarily pinch pennies when you should be living it up. A solid income strategy tackles withdrawal rates, the sequence for tapping different account types, Social Security timing decisions, and whether guaranteed income sources like annuities make sense for you.

Conclusion

Steering clear of these common retirement planning mistakes takes some homework, self-discipline, and often the insight of a professional who can help you navigate this complicated terrain. The thing is, these errors have a way of snowballing over time, which makes catching and fixing them early absolutely critical for securing your retirement future. By getting an early start, squeezing every drop of value from employer benefits, preparing for healthcare realities, spreading your tax exposure across different account types, and crafting a thorough income strategy, you can dramatically brighten your retirement prospects. Keep in mind that retirement planning isn’t something you do once and forget about, it’s an ongoing journey that needs regular check-ins and adjustments as your life evolves.

-

Celebrity8 months ago

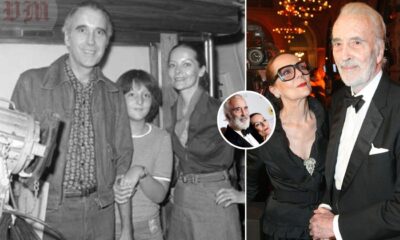

Celebrity8 months agoChristina Erika Carandini Lee: A Life of Grace, Heritage, and Privacy

-

Celebrity8 months ago

Celebrity8 months agoTrey Kulley Majors: The Untold Story of Lee Majors’ Son

-

Celebrity7 months ago

Celebrity7 months agoNick Schmit? The Man Behind Jonathan Capehart Success

-

Celebrity8 months ago

Celebrity8 months agoJamie White-Welling: Bio, Career, and Hollywood Connection Life with Tom Welling