Blog

4 Money Moves Every Professional Should Make Before Year-End

As the calendar approaches its final weeks, professionals often focus on wrapping up projects and preparing for the new year. Yet financial planning deserves just as much attention during this period. Year-end is the perfect time to evaluate your financial health, make adjustments, and position yourself for success in the months ahead. By taking proactive steps now, you can reduce stress, maximize opportunities, and ensure your finances are aligned with your long-term goals.

Maximize Retirement Contributions

One of the most effective year-end strategies is reviewing retirement accounts. Contributing the maximum allowable amount to a 401(k), IRA, or other retirement plan not only strengthens your future financial security but also provides immediate tax benefits. Many employers offer matching contributions, and failing to take full advantage of this benefit means leaving money on the table. Even modest increases in contributions can compound significantly over time, making this a crucial move for professionals who want to build long-term wealth.

Review Tax Planning Opportunities

Tax season may still be months away, but year-end is the ideal time to prepare. Professionals should evaluate deductions, credits, and strategies that can reduce taxable income. Charitable donations, contributions to health savings accounts, and deferring income when possible are all effective tactics. For those with investments, tax-loss harvesting can offset gains and minimize liabilities. To seek expert guidance in these areas consider searching based on your current location, such as Denver financial advice if you live in the Colorado area to get a better idea on how to tailor strategies that will make sense for your state. Proactive tax planning now can prevent surprises later and help you retain more of your earnings.

Rebalance Your Investment Portfolio

Market fluctuations throughout the year can cause portfolios to drift away from their intended allocations. Rebalancing ensures that your investments remain aligned with your risk tolerance and long-term objectives. This may involve selling assets that have grown disproportionately and reinvesting in areas that need strengthening. Rebalancing not only maintains stability but also positions your portfolio for growth in the coming year. Reviewing your investments at year-end provides clarity and helps you make informed decisions about diversification and future opportunities.

Strengthen Your Emergency Fund

An emergency fund is a cornerstone of financial resilience, yet many professionals overlook its importance. Unexpected expenses such as medical bills, car repairs, or sudden job changes can quickly derail financial progress if savings are insufficient. Year-end is the perfect time to evaluate your emergency fund and make contributions to strengthen it. Aim to have three to six months of living expenses set aside in a separate, easily accessible account. Even small, consistent deposits can build a reliable safety net over time, providing peace of mind and protecting your long-term goals.

Conclusion

Year-end financial planning is about more than closing the books it is about setting the stage for future success. Maximizing retirement contributions, reviewing tax strategies, rebalancing investments, and strengthening emergency savings are four essential moves every professional should make before the year ends. These steps not only protect your current financial health but also create momentum for growth in the year ahead. Taking action now ensures that you enter the new year with confidence, knowing your finances are organized, optimized, and ready to support your goals.

-

Celebrity9 months ago

Celebrity9 months agoNick Schmit? The Man Behind Jonathan Capehart Success

-

Celebrity9 months ago

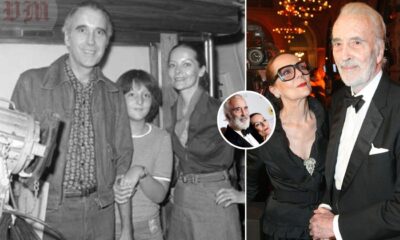

Celebrity9 months agoChristina Erika Carandini Lee: A Life of Grace, Heritage, and Privacy

-

Celebrity9 months ago

Celebrity9 months agoTrey Kulley Majors: The Untold Story of Lee Majors’ Son

-

Celebrity9 months ago

Celebrity9 months agoJamie White-Welling: Bio, Career, and Hollywood Connection Life with Tom Welling