Business

Wealth Management Tips for High-Net-Worth Individuals

Managing significant wealth requires more than just saving and investing—it demands a strategic, holistic approach that protects assets, minimizes risk, and ensures long-term growth. High-net-worth individuals (HNWIs) face unique financial challenges and opportunities, from complex tax considerations to legacy planning. Whether you’re newly affluent or have managed wealth for years, these tips can help you make smarter decisions and preserve your financial legacy.

Prioritize Comprehensive Financial Planning

Wealth management begins with a comprehensive financial plan tailored to your unique goals and lifestyle. This plan should encompass short- and long-term objectives, including retirement, philanthropy, estate planning, and business succession if applicable. Unlike basic budgeting, high-net-worth planning often involves multiple income streams, diverse investments, and intricate tax scenarios.

A well-structured plan helps you stay organized and proactive. It should be reviewed regularly to reflect changes in your financial situation, market conditions, or personal priorities. Working with professionals who understand the nuances of wealth management ensures that your plan remains aligned with your evolving needs.

Diversify Beyond Traditional Investments

Diversification is a cornerstone of smart investing, but for HNWIs, it goes beyond stocks and bonds. Consider alternative investments such as private equity, hedge funds, real estate, and commodities. These asset classes can offer higher returns and reduce exposure to market volatility.

However, alternative investments often come with higher risks and less liquidity. Due diligence is essential—evaluate the track record, management team, and underlying strategy of any investment before committing capital. Diversification should also extend across geographies and industries to mitigate systemic risks and capitalize on global opportunities.

Implement Strategic Tax Planning

Tax efficiency is critical for preserving wealth. High-net-worth individuals are subject to complex tax regulations, including income tax, capital gains tax, estate tax, and sometimes international tax obligations. Strategic planning can help minimize liabilities and maximize after-tax returns.

Techniques such as tax-loss harvesting, charitable giving, and utilizing tax-advantaged accounts (like IRAs or donor-advised funds) can significantly reduce your tax burden. Business owners may benefit from entity restructuring or deferred compensation plans. Collaborating with a tax professional ensures compliance while optimizing your financial outcomes.

Protect Your Assets with Risk Management

With greater wealth comes greater exposure to risk. Asset protection strategies are essential to safeguard your holdings from lawsuits, creditors, and unforeseen events. Consider establishing trusts, incorporating liability insurance, and using legal entities to separate personal and business assets.

Estate planning is another critical component. A well-crafted estate plan ensures your wealth is distributed according to your wishes and can reduce estate taxes. Tools like irrevocable trusts, family limited partnerships, and life insurance can help preserve your legacy and provide for future generations.

For personalized guidance, many HNWIs turn to a financial advisor in Scottsdale or wherever they live. These professionals understand the local economic landscape and offer tailored strategies that align with your financial goals and risk tolerance.

Focus on Legacy and Philanthropy

Wealth management isn’t just about accumulation—it’s also about impact. Many high-net-worth individuals prioritize legacy planning and philanthropy as part of their financial strategy. Whether through charitable foundations, donor-advised funds, or direct giving, philanthropy can be a powerful tool for social change and tax efficiency.

Legacy planning also involves preparing the next generation to manage wealth responsibly. Consider family meetings, financial education, and involving heirs in decision-making. A thoughtful legacy plan ensures your values and vision endure beyond your lifetime.

Conclusion

Managing substantial wealth requires a proactive, informed approach that balances growth, protection, and purpose. By developing a comprehensive financial plan, diversifying investments, optimizing tax strategies, mitigating risks, and planning for legacy, high-net-worth individuals can secure their financial future and make a lasting impact. With the right guidance and tools, wealth becomes not just a resource—but a legacy.

-

Celebrity9 months ago

Celebrity9 months agoNick Schmit? The Man Behind Jonathan Capehart Success

-

Celebrity9 months ago

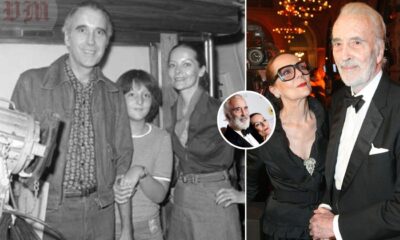

Celebrity9 months agoChristina Erika Carandini Lee: A Life of Grace, Heritage, and Privacy

-

Celebrity9 months ago

Celebrity9 months agoTrey Kulley Majors: The Untold Story of Lee Majors’ Son

-

Celebrity10 months ago

Celebrity10 months agoJamie White-Welling: Bio, Career, and Hollywood Connection Life with Tom Welling