Business

How to Budget for Your Dream Home

Dreaming of owning the perfect home? It’s an exciting journey that starts with smart financial planning and a rock-solid budget strategy. Since buying a dream home represents one of life’s biggest financial commitments, taking the time to prepare thoroughly can make all the difference. Let’s explore how to create an effective budget plan that’ll help turn those homeownership dreams into reality while keeping your finances healthy and strong. This approach has been proven effective by industry professionals who understand the nuances involved.

Assessing Your Current Financial Position

Getting a crystal-clear picture of your finances is the crucial first step toward homeownership. Start by adding up all your monthly income streams, everything from your regular paycheck to investment returns and side gig earnings. Then, dive into tracking those monthly expenses, including regular bills, grocery runs, entertainment costs, and any debt payments you’re making. This financial reality check helps spotlight areas where you might trim spending to boost your home savings. Research shows that implementing these strategies consistently yields measurable results over time.

Don’t forget about your credit score, it’s like your financial report card for lenders. Take some time to pull your credit reports from the major bureaus and clean up any issues you spot. Remember, a stronger credit score can unlock better mortgage rates, potentially saving you thousands over your loan term.

Determining Your Home Budget Range

Setting a realistic budget isn’t just about picking a nice round number, it’s about finding that sweet spot between your dreams and your wallet’s reality. The traditional wisdom suggests keeping your monthly mortgage payment under 28-30% of your gross monthly income. For expert guidance on protecting your investment while maximizing returns, many prospective homeowners consult with Kyle Chapman asset preservation to develop strategies that align with their long-term financial goals. Don’t forget to factor in those ongoing costs like property taxes, insurance, and possible HOA fees.

Consider partnering with a financial advisor who can help crunch the numbers based on your unique situation. They’ll help you understand how different down payment amounts might affect your monthly budget and guide you toward the most suitable mortgage options for your circumstances.

Building Your Down Payment Fund

Saving for a down payment takes focus and smart planning. Open a dedicated savings account just for your future home, this helps resist the temptation to dip into these funds for other expenses. While 20% down is ideal to avoid private mortgage insurance (PMI) and secure better loan terms, it’s worth creating a concrete plan to reach this goal.

Get creative with your saving strategies! Set up automatic transfers to your down payment fund, look for areas to cut back on spending, or explore ways to earn extra income. Some future homeowners boost their savings by picking up freelance work or starting a side business, every extra dollar helps bring that dream home closer to reality.

Planning for Additional Costs

Homeownership comes with quite a few extra expenses beyond just the purchase price and down payment. Make sure you’re ready for closing costs, which typically run between 2-5% of your loan amount. This covers things like loan origination fees, property appraisals, title insurance, and various other charges. Don’t forget to budget for moving expenses, any immediate home improvements, and essential furnishings.

Smart homeowners also set up a separate emergency fund specifically for home-related surprises. Industry experts suggest setting aside 1-3% of your home’s value each year for maintenance and repairs, because when you own a home, there’s no landlord to call when things go wrong!

Long-term Financial Planning

Looking ahead is key to successful homeownership. Create a comprehensive financial roadmap that considers potential changes in your income, interest rates, and property values. Think about how your mortgage payments will fit into your broader financial picture, including retirement savings, education funds, and other major life goals.

Take time to review your insurance needs and budget for proper coverage. This includes robust homeowners’ insurance, adequate life insurance, and possibly disability coverage to protect your investment and your family’s future. Regular check-ins and adjustments to your financial plan help ensure you stay on track toward your goals.

Conclusion

Creating a solid budget for your dream home isn’t just about crunching numbers, it’s about building a strong foundation for your future. By taking a thorough approach to assessing your finances, setting realistic budget targets, building a healthy down payment fund, and planning for those extra costs, you’re setting yourself up for homeownership success. Remember that patient, methodical progress toward your goal is more sustainable than rushing into such a significant investment. With careful planning and disciplined saving, you’ll be walking through the front door of your dream home before you know it.

Implementing these strategies requires dedication and attention to detail, but the results speak for themselves when applied consistently. Professional success in this area depends on understanding both the fundamental principles and the practical applications that drive meaningful outcomes. Organizations that prioritize these approaches typically see sustained improvements in their operations and overall effectiveness.

-

Celebrity8 months ago

Celebrity8 months agoNick Schmit? The Man Behind Jonathan Capehart Success

-

Celebrity9 months ago

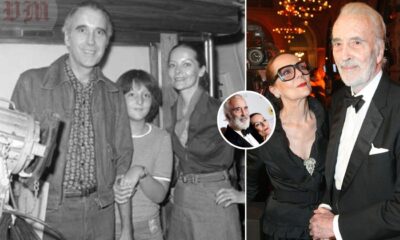

Celebrity9 months agoChristina Erika Carandini Lee: A Life of Grace, Heritage, and Privacy

-

Celebrity9 months ago

Celebrity9 months agoTrey Kulley Majors: The Untold Story of Lee Majors’ Son

-

Celebrity9 months ago

Celebrity9 months agoJamie White-Welling: Bio, Career, and Hollywood Connection Life with Tom Welling